You sell everywhere, but where do you have to collect and pay sales tax? It’s all about nexus, and we’ll break it down for you here.

It’s been over 5 years since the Supreme Court ruled in favor of South Dakota in their case against Wayfair. The ruling provided states the option to bind companies to collect sales tax in their state based on how much they sell which created the new concept of economic nexus.

In typical government fashion, states put in place their own specific rules versus coming together to agree on common sets of criteria. Today, every state or territory that collects sales tax has an active economic nexus law.

The goal of this blog is to provide some transparency for understanding economic nexus, the criteria being used by states and a way to estimate your potential state exposure.

First, the concept of physical nexus is still a thing. The most common triggers of physical nexus are having locations, employees or inventory (including via 3PLs) in a state. Other triggers can include working with 3rd party affiliates or temporarily doing business in a state such as attending a trade show, pop-up shops or providing onsite training.

Now let’s take a look into economic nexus. These laws can be triggered based on your order volume and/or revenue amounts, the channels you sell in and time periods as defined by each state. Ecommerce merchants continue to struggle with understanding what states they need to collect sales tax in. It’s a blind spot for them! Common questions include:

- What is counted towards the thresholds? Orders, revenue or both?

- Do marketplace and wholesale orders also count?

- Is there a timeline I should use for determining economic nexus?

Diving into the specifics

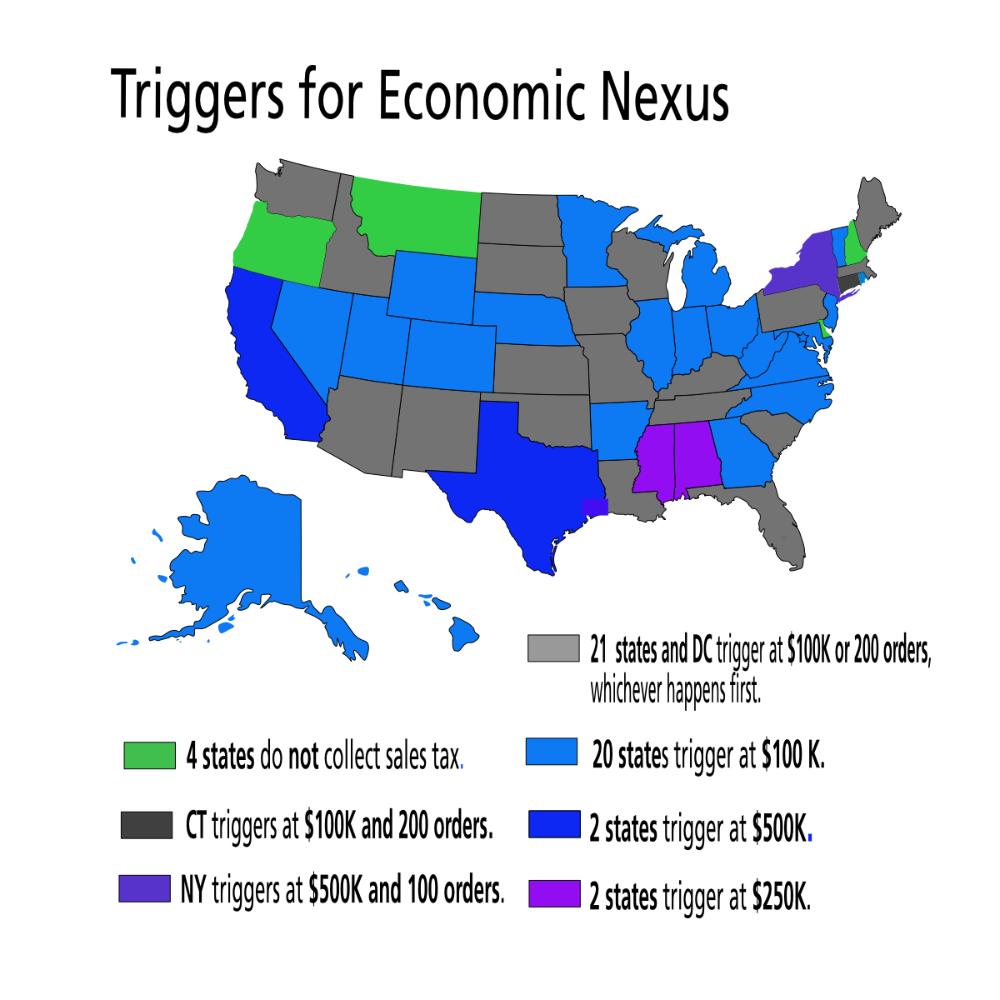

States currently have economic nexus thresholds based on one of these 5 sales categories:

- 200 orders OR $100,000 in revenue

- 200 orders AND $100,000 in revenue

- 200 orders AND $500,000 in revenue

- $100,000 in revenue

- $500,000 in revenue

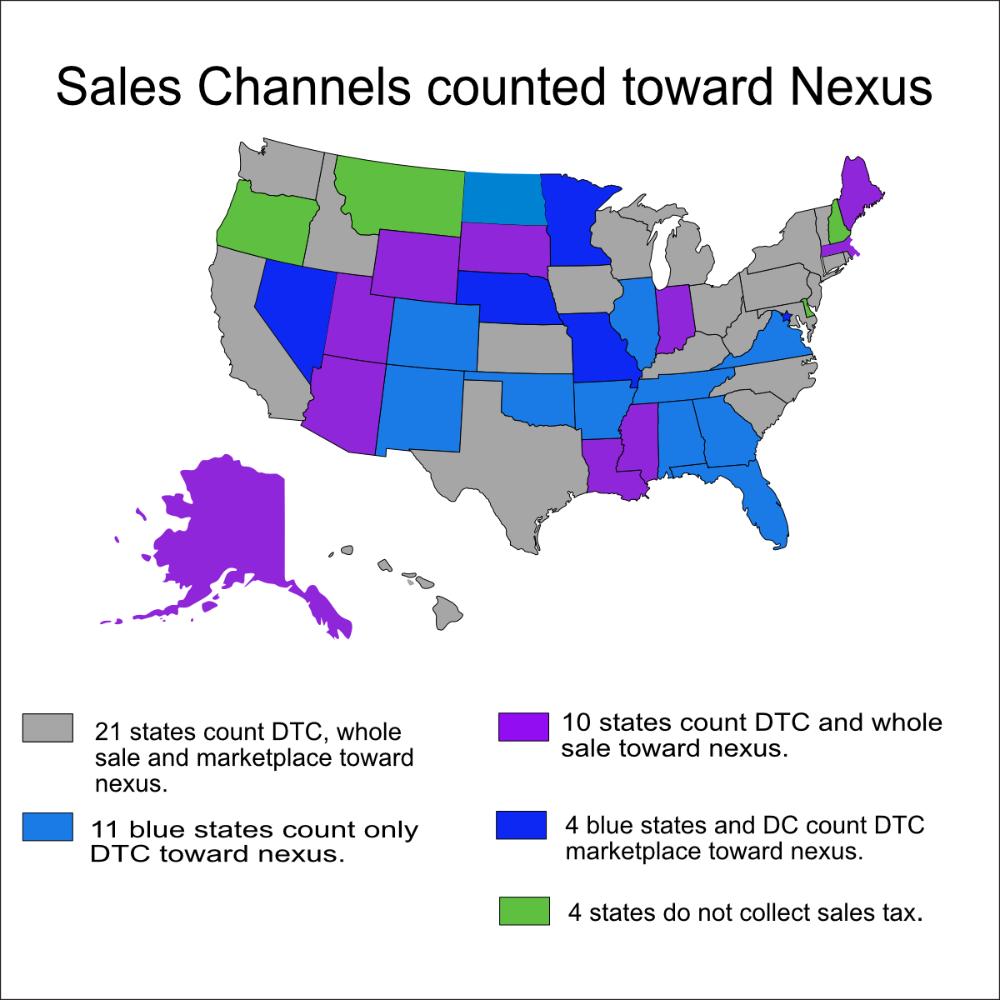

Sales channels that count towards economic nexus can be either:

- Taxable sales for Direct-to-Consumer (DTC)

- DTC + Wholesale

- DTC + Marketplace (eg Amazon)

- DTC + Wholesale + Marketplace

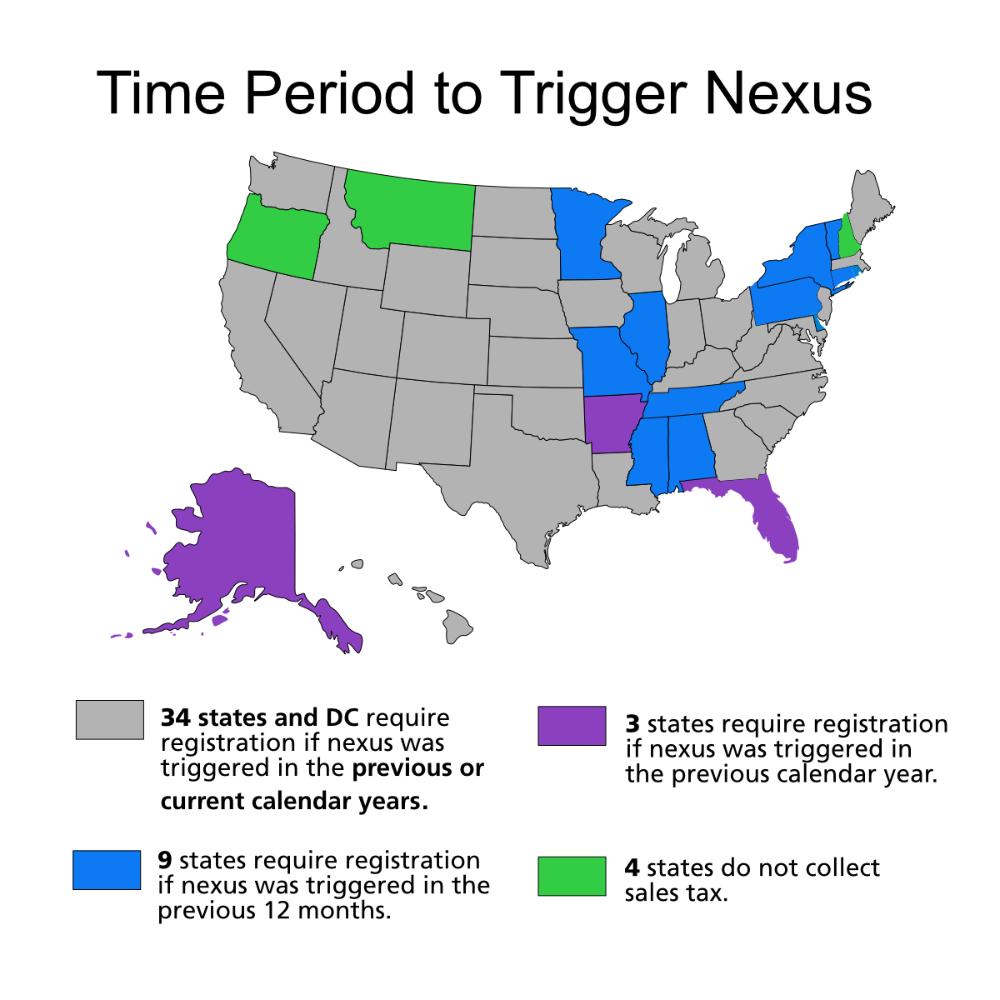

The time period the thresholds are tracked against include:

- Previous calendar year

- Previous or current calendar year

- Previous 12 months

A ‘rough’ method to estimate exposure

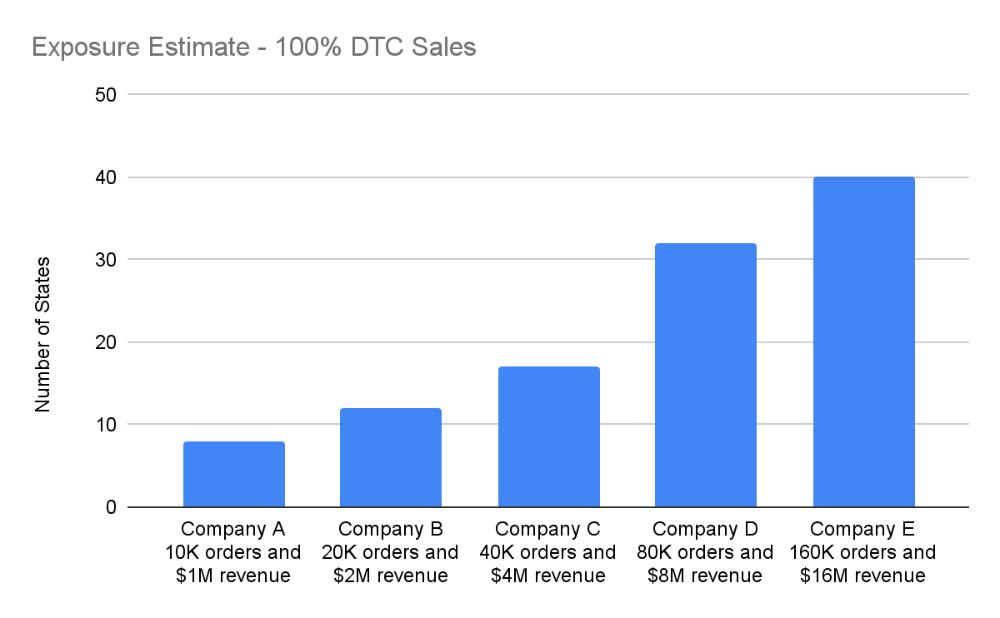

Using ratios from data provided by the US Census Bureau on % of personal consumption expenditures for each state and applying that to current economic nexus laws against company examples based on sales and channels, I’ve put together a method of estimating your potential economic nexus exposure. This is ONLY a ‘rough’ estimator and does not factor in all of the variables that go into a thorough economic nexus analysis.

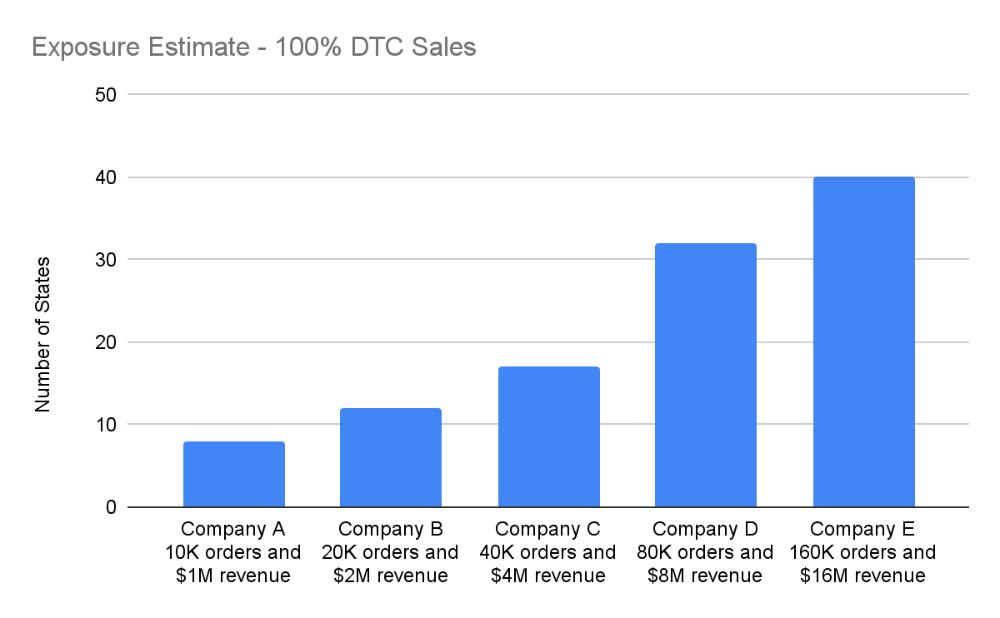

The first example is for ecommerce merchants that sell 100% of revenue DTC. It uses different sales amounts and assumes an average sales price of $100 USD.

The second example is for merchants selling 20% DTC, 40% via wholesale and 40% marketplaces using the $100 average sales price.

A couple of conclusions from this exposure analysis:

- Economic Nexus starts early and grows quickly

- Ecommerce merchants selling $1M per year regardless of their sales channels mix will cross thresholds in multiple states. Sales growth exponentially increases nexus states.

- Multi-channel sales impact

- Merchants with revenue between $1M-$2M annually selling in multiple channels can see a meaningful decrease in the total number of state thresholds it will trigger. This impact levels off when merchants exceed $4M or more annually.

- Collecting sales tax in every state?

- A nationwide requirement for collecting sales tax in every state is only a stone’s throw away from the example company with $16M in sales. $20M+ could get you there.

Understanding economic nexus is a challenge for many businesses. The laws use multiple variables and vary by state. Unless you want to become a sales tax expert, manual tracking is not an option. If you’re using a service to track your company’s exposure, be sure it’s using the correct criteria against all of the channels you sell in. If you have any questions or concerns, it never hurts to do a nexus analysis to ensure your company is currently compliant.